To apply for a new TCFCU VISA Credit Card click below:

We transitioned to an internal VISA platform, which enables members to view transaction history, holds, temporarily lock their card and even make payments to the card within Online Banking!

About TCFCU VISA Credit Cards

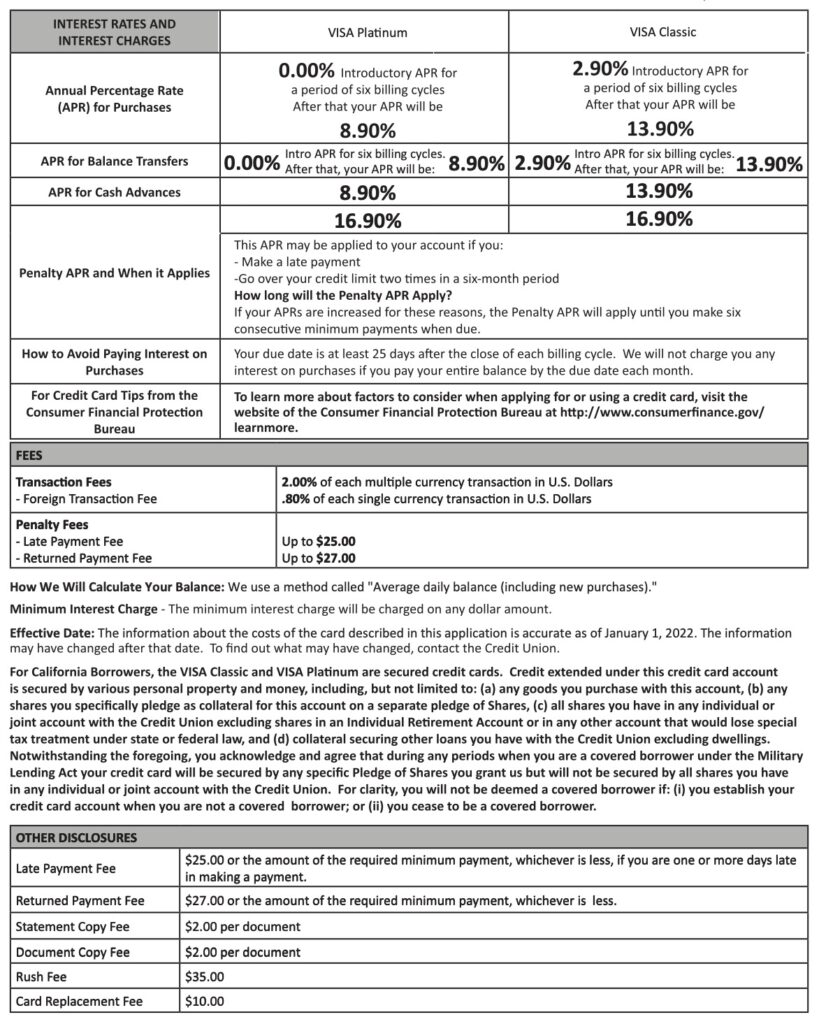

The Platinum VISA offers a 0% introductory APR on purchases for the first six billing cycles. The Classic VISA is a 2.9% APR on purchase for the first six billing cycles. After the introductory time, interest rates are as low as 8.9% APR, with no annual fee, and low monthly payments.

You can access your VISA account by logging into Online Banking from the homepage or by calling CUTalk at 800-860-5704 to hear balances and other information on your VISA card account, along with information on all other TCFCU accounts.

ScoreCard Rewards

Enjoy a great rewards program with your TCFCU VISA. Points can be redeemed for travel or merchandise. View your ScoreCard Reward points at www.scorecardrewards.com.

Tap and Pay

Learn how to set up Apple, Samsung or Google Pay on your smartphone HERE.

VISA Credit Card Payments

Payments can be made through online banking or mailed to the Veterans Drive branch at 3797 Veterans Drive, Traverse City, MI 49684. VISA payments are due by the 28th of each month.

Request a Credit Card Limit Increase** By submitting this LOC/credit card limit increase form you are authorizing TCFCU to pull your credit report, if necessary, to update our files.Current VISA Rates and Disclosures